How Much Does a Million Dollar Life Insurance Policy Cost in 2021?

In 2021, a healthy 40 year old male can still get a 20 year million dollar life insurance policy for just $50/month. Does that surprise you?

Most people over-estimate the cost of life insurance.

You can find out how much a million dollar life insurance policy would cost you using the calculator above.

Is a Million Dollar Life Insurance Policy Enough?

You’re wondering how much a million dollar life insurance policy costs, and you can find out in less than a minute with the calculator above, but why on Earth did you choose one million dollars?

I’ll admit, the thought of having any number of dollars ending in “million” produces a blast of safety and peace of mind in my brain. But if you were left without a loved one’s income, would a million dollars truly be enough? Or is it too much? How do you know either way?

What Are Your Current Expenses?

Your income provides many things for your family. It’s crucial and losing it could result in catastrophe.

Everyday Living. Food, housing, transportation, health insurance. Think of all the common things you may take for granted. Your income provides for all of it. Depending on where you live, everyday living expenses could be $20,000 to $80,000 every year! A million dollar life insurance policy should definitely be able to cover your everyday living expenses.

Debt Repayment. Americans are in debt. Lots and lots of debt. $4.1 trillion to be exact. Student loans, auto loans, and credit cards make up the vast majority of this number. Chances are you and your family represent a small portion of that $4.1 trillion. Life insurance can help to wipe away the burden debt will place on your family left behind.

Mortgage. In addition to the staggering amount of personal debt, Americans on average owe $200,935 on their mortgages according to TransUnion. Owing money on the home you live in is a major worry for people I talk to. My clients looking for a million dollar life insurance policy often mention their mortgage as the primary reason they are looking for life insurance. They want to leave their family with a paid-off home.

Future Expenses

Kids College. After mortgage debt, providing for their children’s college education is the second most popular reason clients look for a million dollar life insurance policy. The average per year cost of college in 2019 is $25,290 to $50,900 depending on the type and location of the school. Nearly all of that tuition is paid for with student loans or a parent’s income.

If you were to pass away, would your spouse or partner’s income alone be enough to pay for all the current and future expenses you have?

Probably not. And to make matter worse, you’ll add to that burden with Final Expenses.

Final Expenses

Burial Expenses. It’s not fun to talk about but leaving this world costs money. A basic funeral costs $8,755 on average according to the National Funeral Directors Association. All too often those left behind without life insurance benefits turn to crowdfunding sites like Gofundme to pay for it. This most basic need at the time of your death should always be covered by life insurance, whether part of a million dollar life insurance policy, or a smaller final expense policy.

Time Off for Grieving. Losing a loved one is not an easy thing to deal with. Those left behind often need plenty of time to transition into life without their spouse, partner, parent, etc. But how do you do that with only 2 weeks vacation and 3 sick days? Obtaining a large enough life insurance benefit can help pay the expenses while you take the time off you need.

Medical Bills. As if all the other expenses listed weren’t enough, you will likely be saddled with medical bills left over from the illness or injury that led to the death of your loved one. Medical bills account for 66.5% of bankruptcies. You’re going to want to make sure you account for medical bills when determining the amount of life insurance you purchase.

Do a Needs Analysis

After listing all the current, future, and final expenses you may leave behind, a million dollar life insurance policy doesn’t seem as much as it once did.

The only way to truly know if a million dollar life insurance policy is enough to take care of these expenses without adding extra burden on your family is to do a needs analysis.

A “needs analysis”? I know I sound like a teacher assigning homework but stick with me because I’m going to make this easy.

If you know some basic numbers like your current income, mortgage, and debts, you can do a needs analysis in a couple minutes using this painless tool:

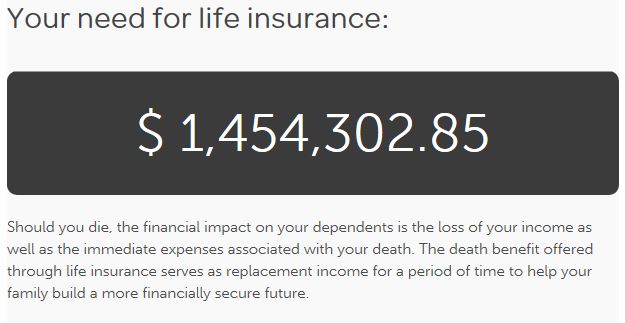

I ran a sample needs analysis using that tool in just 63 seconds. Here are my results:

If I had used the feel-good one million dollar coverage amount, I would be leaving my family short a whopping $454,302.85! Ouch.

One more thing to consider when doing your needs analysis…Inflation.

I have helped many clients review their current life insurance policies. One thing they all have in common is that they don’t seem like much these days. What once was their idea of a lot of money is now only enough to pay for their burial.

Important Factors Affecting the Price of a Million Dollar Life Insurance Policy

While the price of most things we buy is determined by market demand, the price of life insurance is determined by actuaries who base their prices on very specific factors:

Age. The average life expectancy for an American male is 78.69 years. The closer your age is to that number, the more you will be charged for life insurance. Simple, right?

Health. Almost all life insurance applications will put you through some sort of medical underwriting where you are asked a series of questions about your health history. Medical records are then, in most cases, accessed to help the insurance company learn more about your health. And finally, you may be asked to go through a simple medical exam at your home or office, though this is not a requirement for all life insurance policies. Any number of health issues may raise the price of a million dollar life insurance policy, but the most common are diabetes and heart conditions. Make sure you are completely honest with your agent so you can be placed with an insurance company that is best suited to accept your particular health condition.

Lifestyle Factors Affecting the Price of a Million Dollar Life Insurance Policy

Tobacco. Are you a smoker? Were you a smoker? What about chewing tobacco or the occasional cigar? How about marijuana or vaping? The hard truth is that all forms of tobacco lead to a lower life expectancy and your history of tobacco use is a huge factor in your life insurance rates. Smokers can expect to pay two to three times more than non-smokers for the same million dollar life insurance policy. Quitting is obviously a great thing to do, but keep in mind that insurance companies will want to see a long and documented history of having quit before considering you a non-smoker.

Height/Weight. Your build is an simple but mostly accurate indicator of your overall health. Life insurance companies have “Build Charts” which list height and weight and assign a “class” based on where you fall in that chart. There are generally 12 classes ranging from Preferred Plus to Standard and then Table 1 through Table 8. The lower down the class range you fall, the more expensive your million dollar life insurance policy will be.

Additional Factors Affecting the Price of a Million Dollar Life Insurance Policy

Sex. Men pay more for life insurance than women. That’s very easy to notice when you look at a simple life insurance rate chart, but why? It all comes down to risk. Men have shorter life spans than women. In fact, according to this article from Harvard Medical School, 67% of those age 85 and older are women. As we discussed above in the Age section, life expectancy plays a huge part in life insurance rates.

Family History. Many people don’t realize it but their parents or siblings may be costing them money when it comes to life insurance. Insurance companies want to know about your family history. Has anyone in your immediate family (mother, father, brother, or sister) been diagnosed or passed away from stroke, cancer, or heart disease before the age of 70? If so, your million dollar life insurance policy may cost more than someone who has no family history of these illnesses.

Personal History. Have you ever been convicted of a felony? Have a recent bankruptcy? What about the things you do for fun…fly a plane? Jump out of them? Climb rocks or hang glide? Like to scuba dive? All these details of your personal history and lifestyle will be taken into consideration when applying for a million dollar life insurance policy.

Some of these factors, including poor health, may prevent you from getting a million dollar life insurance policy altogether. If that is the case, you’ll want to consider a Guaranteed Issue life insurance policy. It won’t cover you for a million dollars but it will provide some peace of mind when it comes to final expenses.

Popular Types of Million Dollar Life Insurance Policies

When shopping for life insurance, you will mainly come across two types of policies: term and whole.

Term life insurance covers you for a specific period of time (or term), often 10, 20, or 30 years although 35 and 40 year policies are also now available. If something were to happen to you during that term, your beneficiaries would receive the life insurance benefit you purchased. Once the term has expired, coverage ceases.

Whole life insurance covers you for your whole life. The coverage will never cease as long as you are paying the agreed upon premiums. So, theoretically, your beneficiaries are guaranteed to receive the life insurance benefit you purchased*. But, you’re going to pay for that guarantee, often 10 times the price of a 30 year term million dollar life insurance policy.

When looking for life insurance, make sure to ask your agent about Living Benefits as well.

*Whole life insurance also accumulates cash value that you can borrow against. If you borrow your cash value or reduce your monthly paid premiums, you can eliminate the guaranteed death benefit if the loans are not repaid. But for the sake of this article, I am assuming you are only buying a million dollar life insurance policy for the death benefit, and not the cash value feature.

Other Types of Million Dollar Life Insurance Policies

These other types of million dollar life insurance policies aren’t as popular but let’s take a look anyway.

Return of Premium life insurance can be designed for term or can last your whole life by adding a simple rider. Here is an in-depth look at Return of Premium life insurance.

Guaranteed Universal Life Insurance is a universal life insurance policy that guarantees the death benefit for a certain amount of time long past what traditional term life insurance policies offer. In fact, these policies can last until age 90, 95, 100, all the way up through age 121.

Who Needs a Million Dollar Life Insurance Policy?

The truth is that not everyone needs a million dollar life insurance policy. If you’ve done the needs analysis linked above and came up with a number below one million dollars, then by all means buy a policy for that lesser coverage amount.

Having said that, these are the people most likely to need a million dollar life insurance policy:

Head of Household. Remember when we listed all the current, future, and final expenses? Those are usually paid for by the main income earner in a household. This person may need a million dollar life insurance policy or perhaps even more.

Spouses or Partners. Spouses and partners who are working but not making the majority of the family income still need to have their income protected. In addition, stay-at-home parents can leave a huge hole in a family dynamic if they were to pass away. Recent surveys show that a stay-at-home mom could earn $162,000 per year if all their services were to be replaced by hired help.

Business Owners. It’s tough to transition a business to a family member or manager. The ones taking over often times don’t have enough money to buy out the departing owner. Life insurance can play a key role in helping to ease the transition. Custom designed policies can provide money in the case of death, illness, or even a living buy-out.

Key Employees. Do you have an employee that is key to your business? One that you can’t imagine continuing on without? If so, then you likely need a million dollar life insurance policy on that key person to be able to transition the business to life without them.

Can I Buy a Million Dollar Life Insurance Policy Without an Exam?

There are several advantages to buying life insurance without a medical exam. No nurse visits and faster approvals are two of them. But one of the disadvantages of these policies is that they typically max out at $500,000 in coverage.

Sure, if you search hard enough you may find a no-exam policy that offers a million dollar life insurance policy, but as we discussed above, is a million dollars enough? If so, then no-exam policies may be the way to go, but expect to pay for the privilege of skipping the exam.

If you’re looking for a policy with benefits over a a million dollars, expect a quick medical exam at the time and place of your choosing when applying for life insurance.

Can I Buy a Million Dollar Life Insurance Policy Through Work?

Just as with no-exam policies, it’s extremely rare to find a million dollar life insurance policy through work. You may find one as part of a fantastic benefits package but normally you will find policies in the $10,000 to $50,000 range.

If your employer does offer a million dollar life insurance policy, be wary still. Life insurance policies through work often end when your employment does. You can learn more about this in our article, 7 Surprising Reasons to Say NO to Life Insurance Through Work.

Sample Quotes for a Million Dollar Life Insurance Policy

Here are some sample million dollar life insurance policy quotes for men and women of different age groups*.

| Age & Sex | 10 Year Term | 20 Year Term | 30 Year Term | Whole Life |

|---|---|---|---|---|

| 30 year old male | $21 | $33 | $58 | $395 |

| 30 year old female | $18 | $26 | $47 | $331 |

| 40 year old male | $29 | $53 | $97 | $564 |

| 40 year old female | $26 | $44 | $77 | $464 |

| 50 year old male | $74 | $142 | $253 | $849 |

| 50 year old female | $62 | $103 | $183 | $702 |

*Premiums shown are an average of the lowest 3 quotes for each class. Rates are for a Preferred Plus non-smoker and are intended to be an example of what premiums may be. These sample rates should not be considered a quote for your particular case as each case is underwritten individually.

Where to Buy a Million Dollar Life Insurance Policy

The best place to start shopping for your million dollar life insurance policy is with an licensed independent life insurance agent.

Independent agents don’t work for one company. Instead they have contracts with several life insurance companies which allow them to match your specific case to the insurance company who is most likely to accept you and provide the best rates.

You can begin shopping right here, right now with instant online quotes.